Bank of England base rate

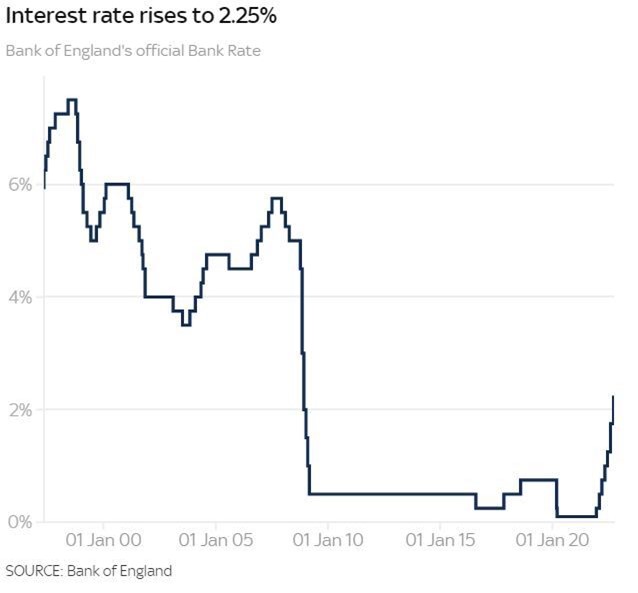

This page was last updated 31 October 2022. On Thursday 22 September the Bank of England base rate increased from 175 to 225.

Negative Rates Explained Should Uk Investors Prepare Schroders Global Schroders

Britains economy is now in recession the Bank of England has said.

. This is called electronic central bank money or reserves. It would increase the rate by 075 on the already increased 05. The Homeowner Variable Rate is 574.

21 July 2022 Deputy Governor of the Bank of England reappointed Deputy Governor of the Bank of England reappointed. Growth and competitiveness speech by Sam Woods. The base rate is the interest rate the Bank of England charges on the money it lends to financial institutions like HSBC.

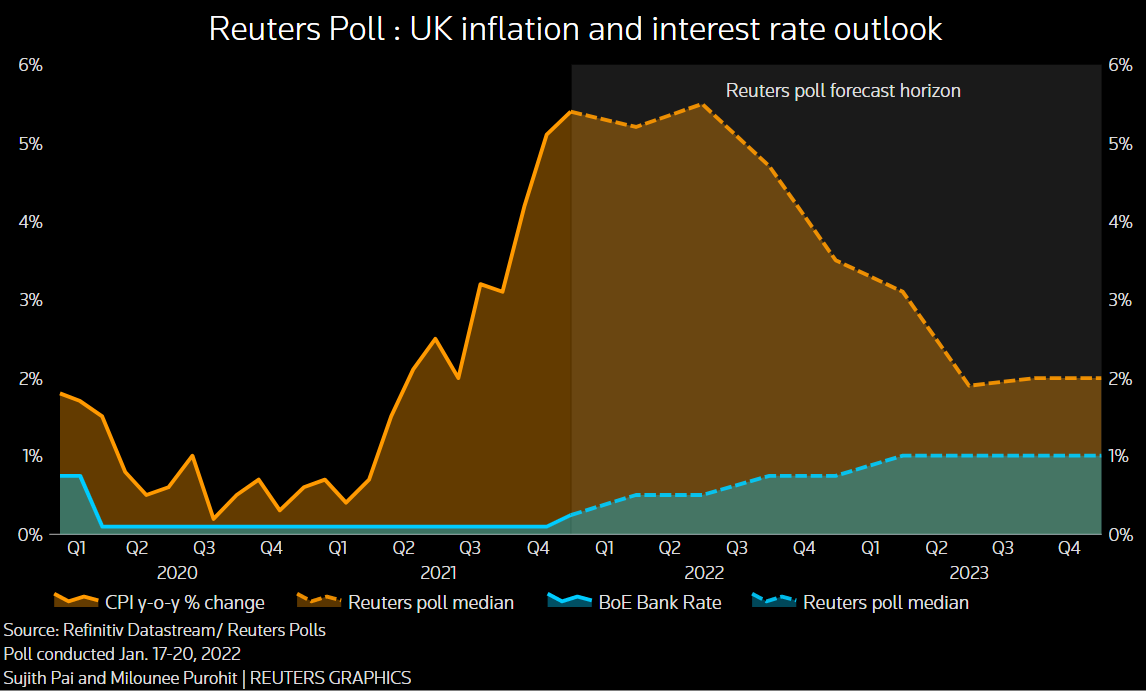

The Bank of Englands Monetary Policy Committee MPC sets monetary policy to meet the 2 inflation target and in a way that helps to sustain growth and employment. The Bank of England Base Rate is 225. Bank Rate increased to 175 - August 2022 Bank Rate increased to 175 - August 2022.

This rate is used by the central bank to charge other banks and lenders when they borrow money and so it influences what borrowers pay and what savers earn. The committee sets the base rate as part of its efforts to keep inflation at 2. Bank Rate influences all the UKs other rates including those you might have for a loan mortgage or savings account.

MPC voted to increase the key base rate by 05 percentage points to 225 its highest level since 2008 judging. Get the latest international news and world events from Asia Europe the Middle East and more. We set the UKs key interest rate Bank Rate.

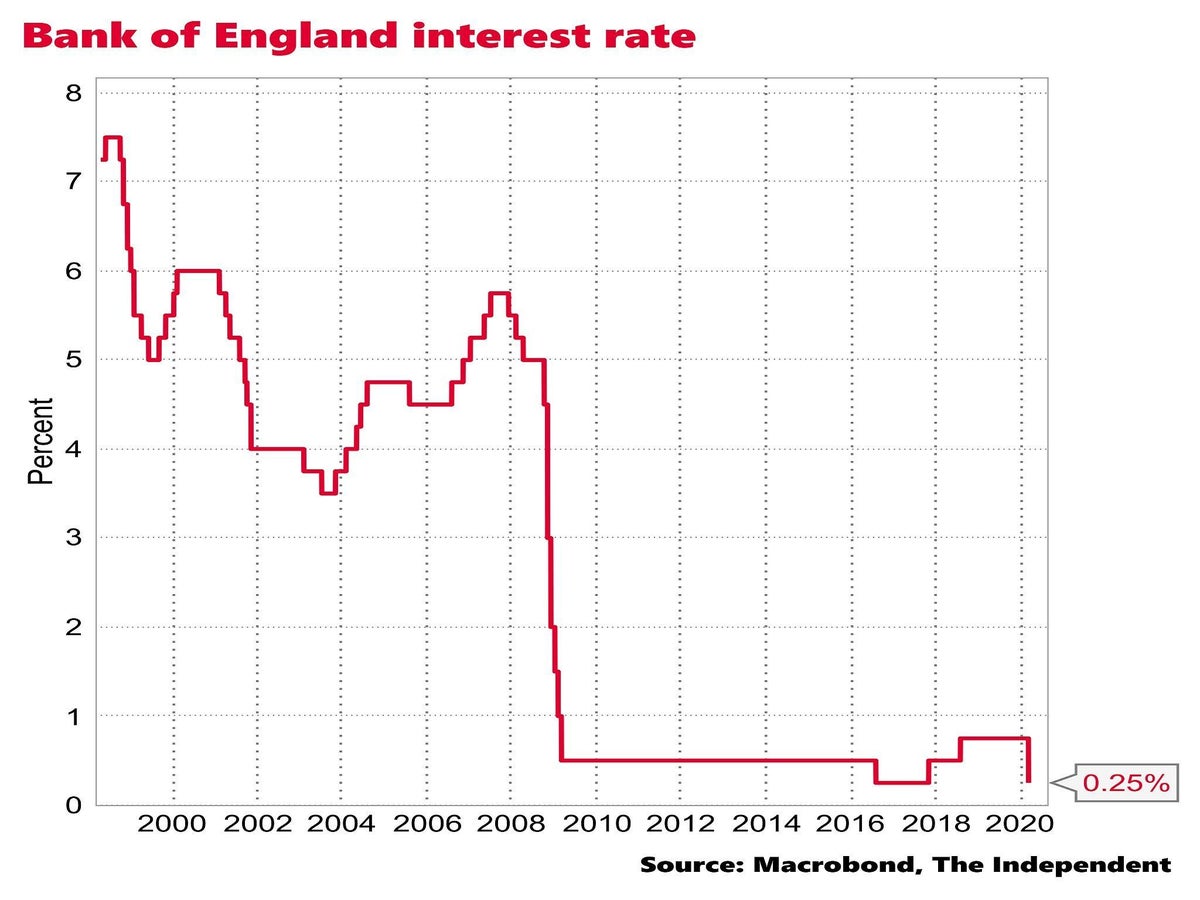

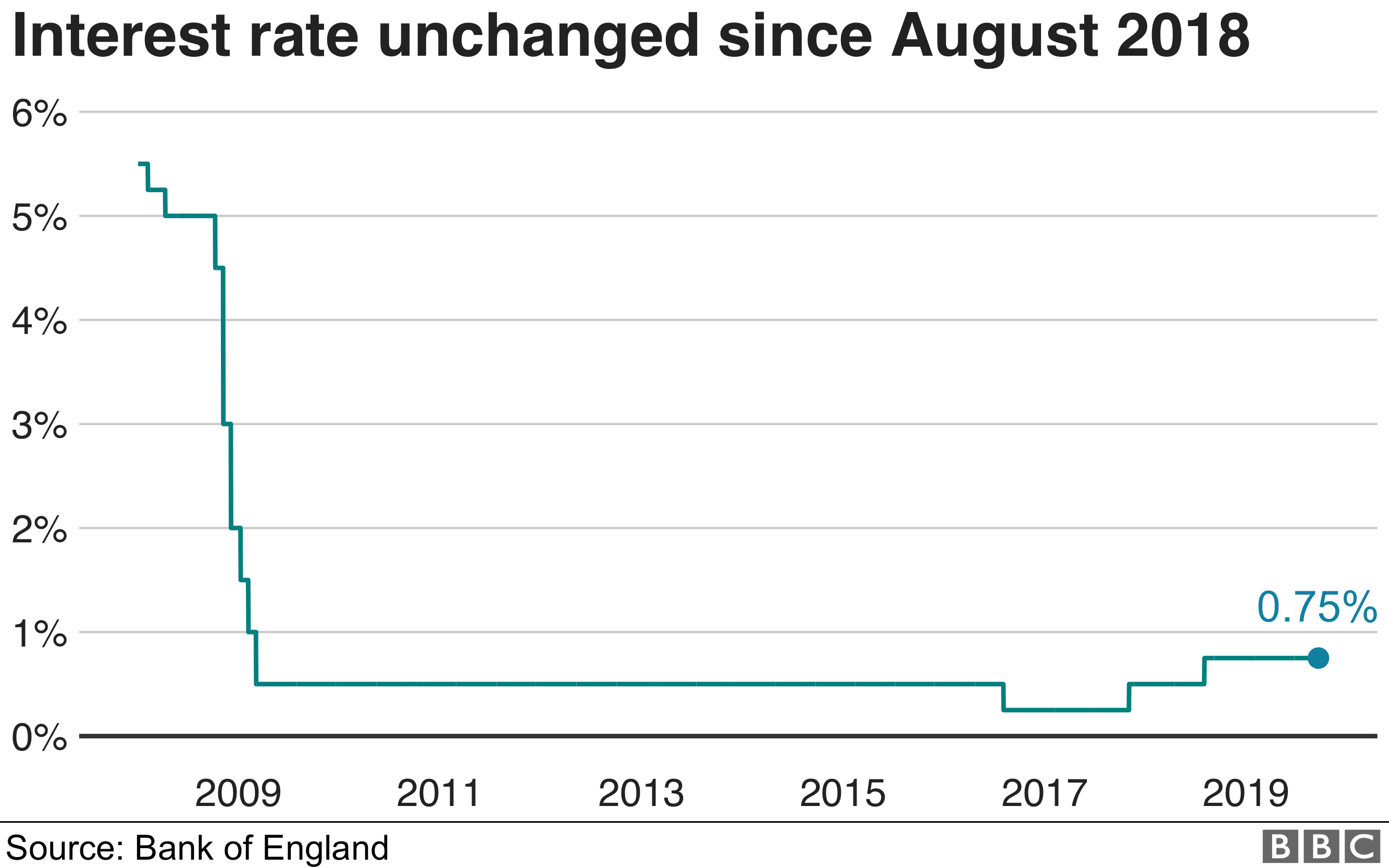

The base rate has changed to 225 Theres no need to call us well write to you if there are any changes to your payments as a result of the base rate increase on 22nd September 2022. The Bank of England has raised interest rates by 05 percentage points to 225 per cent the highest level in 14 years and indicated that the country is already in a recession. Before the Covid-19 pandemic the Bank of England base rate had been slowly climbing to 05 in November 2017 and then 075 in August 2018.

Finally most banks have accounts with us at the Bank of England allowing them to transfer money back and forth. Weve raised Bank Rate from 01 last December to 225 now. At its meeting ending on 3 August 2022 the MPC voted by a majority of 8-1 to increase Bank Rate by 05 percentage points to 175.

Banks create around 80 of money in the economy as electronic deposits in this way. In comparison banknotes and coins only make up 3. The Bank of Englands Monetary Policy Committee MPC sets monetary policy to meet the 2 inflation target and in a way that helps to sustain growth and employment.

What is Bank Rate. The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. The Bank of England Base Rate has been consistently low for a number of years.

The calculator uses the Consumer Price Index CPI as this is the measure used by the Government to set the Bank of Englands target for inflation. In the news its sometimes called the Bank of England base rate or even just the interest rate. Bank Rate is the single most important interest rate in the UK.

But if it changes thisll have an impact on your mortgage payments if you have a mortgage linked to this rate. An alternative credible measure which is the ONSs lead measure of inflation is the Consumer Price Index including Owner Occupiers Housing Costs CPIH. The base rate was increased from 175 to 225 on 22 September 2022.

But this only means more. At its meeting ending on 3 August 2022 the MPC voted by a majority of 81 to increase Bank Rate by 05 percentage points to 175. It then fell to an all-time low of 01 during the crisis only to start to rise again in late 2021 as inflation rose.

The Bank of Englands Monetary Policy Committee MPC sets monetary policy to meet the 2 inflation target and in a way that helps to sustain growth and employment. This includes Santanders Follow-on Rate which will also increase by 050 to 550. Those members in the minority preferred to.

It is more widely known as the base rateor just the interest rate. The inflation calculator also. Our mission is to deliver monetary and financial stability for the people of the United Kingdom.

The Bank of England base rate is the UKs most influential interest rate and its official borrowing rate. View more Monetary Policy Committee announcements and remit letters. The base rate was previously reduced to 01 on 19 March 2020 to help control the economic shock of the coronavirus pandemic.

One member preferred to increase Bank Rate by. The Bank of England BoE is the UKs central bank. The Bank of England base rate is currently 225.

101 Current inflation rate Target 2. At its meeting ending on 15 June 2022 the MPC voted by a majority of 6-3 to increase Bank Rate by 025 percentage points to 125. Bank of England raises base rate to 225 The MPC has voted by a majority of 5-4 to increase the base rate by 05 percentage points.

There are indications that the UK is already in recession as the Bank of England says there will be a 01 GDP decline in this financial quarter. The Bank of England increased its base interest rate to 225 percent in September benchmarked at its highest level in 14 years in a bid to tame the spiralling rates. The Standard Variable Mortgage Rate is 425.

HMRC interest rates are linked to the Bank of England base rate. At its meeting ending on 21 September 2022 the MPC voted to increase Bank Rate by 05 percentage points to 225. Self Employed Mortgage Hub director Graham Cox noted the Bank of England might be forced to hike the base rate if the Sterling falls.

With gas and electricity prices having reached record highs inflation is currently at 99 nearly five times the Banks target. The Bank of England has increased the base rate from 175 to 225 the highest it has been in 14 years. The Bank of England Monetary Policy Committee voted on 22 September 2022 to increase the Bank of England base rate to 225 from 175.

Established in 1694 to act as the English Governments banker and still one of the bankers for the Government of the United Kingdom it is the worlds eighth-oldest bankIt was privately owned by stockholders from its foundation in 1694 until it. The Bank of Englands Monetary Policy Committee MPC sets monetary policy to meet the 2 inflation target and in a way that helps to sustain growth and employment. In light of soaring prices the BoE has increased the base rate at 05 after cutting it.

All Santander mortgage products linked to the base rate will increase by 050 from 3 October.

The Bank Of England Must Weather High Inflation And Meddling Politicians The Economist

Bank Of England Set For Biggest Rate Hike In 33 Years But Economists Expect Dovish Tilt

Call On Bank Of England For 3 Interest Rate To Halt Runaway Inflation Business The Times

Central Bank Watch Boe Ecb Interest Rate Expectations Update

Bank Of England Is Right To Take A Softly Softly Approach On Rates The Washington Post

Bank Of England Hikes Interest Rate To 13 Year High Chinadaily Com Cn

Why Have Interest Rates Been Slashed And What Will The Impact Be The Independent The Independent

Bank Of England To Raise Rates Again In February As Inflation Surges Reuters

Bank Of England Forecasts Low Interest Rates For Longer Bbc News

World S Central Banks Race To Raise Rates After Fed Increase Wsj

Bank Of England Weighs Biggest Interest Rate Rise In 33 Years